2.5. Risk Management

Effective risk management is one of the most important prerequisites for sustainability of Unipro PJSC business. The current integrated risk management system is aimed at the timely identification of risks, as well as the implementation of measures to manage them. The Company regularly reviews the planning, controlling and reporting processes in order to improve the efficiency and predictability of its financial position.

Corporate risk management system

In order to reduce the negative impact of potential hazards and to use favourable opportunities, the Corporate Risk Management System (CRMS) operates at Unipro PJSC.

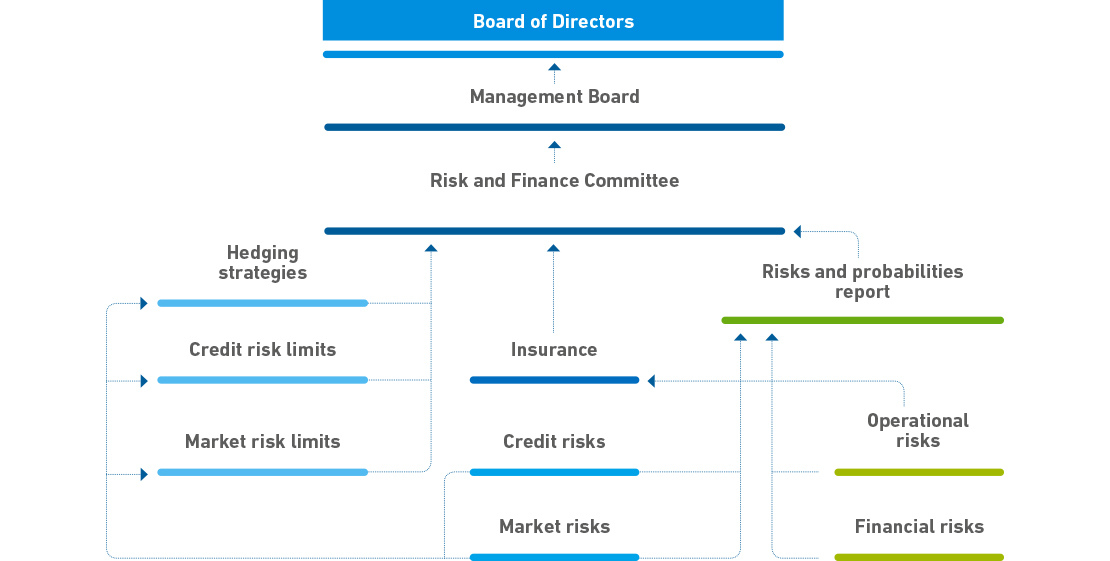

ОCRMS organisational structure

The key elements of the risk management system are the Company’s strategy, internal regulations, including the Regulations on CRMS, controlling, planning, internal control and audit system, risks and opportunities reports, as well as operation of the Risk and Finance Committee.

Scheduled reports are provided on a quarterly basis. Moreover, the Company establishes a procedure for compiling and reviewing urgent reports in case of emerging material risks.

At Unipro PJSC, the effectiveness of CRMS is assessed as follows:

- he management informs annually the Board of Directors on the results achieved in the field of risk management in the framework of corporate reports;

- twice a year, the Risk and Finance Committee evaluates the effectiveness of the CRMS operation in terms of involvement in the process of all relevant functional and legal structures of the Company;

- an independent audit of the risk management system is conducted annually.

- establishing a four-tier system of industrial control and industrial safety management;

- carrying out equipment maintenance in line with a strict schedule;

- ensuring high-quality training of the personnel (especially the employees operating hazardous industrial facilities), assessment of their knowledge and analysis of their reliability based on the investigation of incidents and near misses;

- ensuring systematic work with the personnel to increase their reliability manifesting itself in the absence or minimisation of consequences of any accidents/incidents resulting from human errors;

- implementing a risk-oriented approach to planning targeted measures improving the equipment reliability and implemented as part repair and modernisation operations;

- implementing the recommendations of risk engineers from insurance companies that are based on the best practices in improving the reliability and fire safety of equipment, buildings and structures;

- ensuring thorough supervision over the maintenance personnel in terms of their strict compliance with the procedures for the maintenance and technical acceptance of repaired equipment by the customer’s representatives;

- using the system of regular equipment performance assessment;

- involving specialised contractors to assist with technical condition diagnostics and assessment;

- conducting on-site inspections to assess equipment maintenance readiness and assess the completed repairs;

- investigating all instances of equipment failure affecting the operation of generating equipment;

- calculating and analysing the reliability indicators for equipment groups to forecast its forced unavailability and ensure that investments are used to minimise such forced unavailability;

- analysing changes in the equipment performance indicators and cost/performance ratios;

- implementing a comprehensive programme for the equipment replacement and per-unit reconditioning;

- implementing a comprehensive programme for advanced training of the production personnel;

- standardising repairs, including by developing maintenance data sheets and maintenance workflow specifications;

- providing employees with incentives intended to reduce the equipment damage rate and forced unavailability (including targeted reduction of the bonus rate depending on the contribution of specific employees to the forced unavailability value);

- insuring business interruptions and property damage.

- provision of centralised access to the insurance markets for Uniper group companies;

- support of legal entities and functional units in the analysis to identify, study, evaluate and quantify the risks to be insured;

- development, presentation and provision of risk-adequate and cost-effective insurance coverage, e.g. by considering self-insurance options (through deductibles or franchise pooling) and using internal risk carriers (captive insurance companies);

- ensuring standardised and efficient insurance claims management;

- ongoing monitoring of insurance markets and effective insurance terms.

The Committee ensures implementation of the credit and market risks management strategy, prepares recommendations for the Company’s executive bodies on risk management, reviews and approves risks and probabilities reports.

Performance results of the risk management system in 2018

In the reference period, the Risk and Finance Committee paid special attention to monitoring the risks of the project to restore Power Unit No.3 of Berezovskaya GRES, as well as to the progress of fire hazard reduction recommendations issued during the (Uni)performance inspections (previously Safe.on).

The Treasury Operations and Risk Management Department focused on renewing the insurance coverage for property damage and losses from business interruption in 2019, as well as optimising insurance conditions.

Special attention was also paid to expanding insurance coverage in respect of cybernetic risks and losses from employee disloyalty, expanding the list of insured events, in particular, to the inclusion in the number of insured property losses and business damage of the consequences of terrorist acts and sabotage. In addition, the Company has developed a methodology for assessing risks related to informational security.

Major risk management efforts in 2018 were directed at coordinating interactions of the Company’s divisions and their participation in the identification and mitigation of risks.

However, some risks may still emerge that are currently unknown or insignificant. These risks may negatively affect the future performance of Unipro PJSC.

Plans for 2019

In the coming year Unipro PJSC will continue its continuous optimisation and improvement of the CRMS. The persistent task is to strengthen the risk management function in terms of risk owners’ influence on the quality of risk management processes.

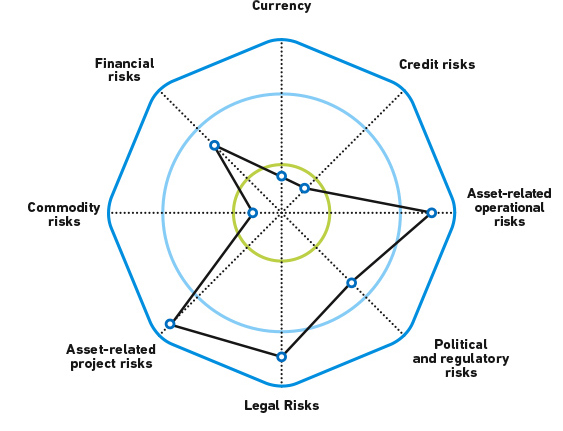

Most material net risks of Unipro PJSC at year end 2018

Risk materiality level* as of the end of 2018

Dynamics of risk materiality in 2018

|

Risk category |

Risk subcategory and preventive measures |

Assessment of materiality and risks dynamics |

|

Market risks |

Commodity risks The main sector exposed to the commodity risk is the day-ahead market, where pricing takes place on an arm’s length principle. Due to significant excess capacities formed in the market as a result of stagnation of power consumption and ongoing commissioning of capacities by generators under investment programmes, the competition between generators and pressure on the free price are increasing. Nevertheless, the Company utilises all methods provided by the Rules of Wholesale Market to increase its revenues from electric power sales in the free market sector. |

|

|

Currency The Company minimises the foreign exchange risk by hedging future liabilities in foreign currency. |

|

|

|

Credit risks |

Unipro PJSC manages credit risks by assessing fair practices of counterparties, by setting and controlling limits on transactions with financial institutions. In its operations, the Company has to supply electricity to certain regions of the Russian Federation, which fail to pay for consumption in full or in due time and increase their receivables to Unipro PJSC. |

|

|

Financial risks |

Financial risks The tax system efficiency is affected by an excessive number of tax control activities, staff shortage in tax agencies and complexity of the Russian tax laws. All these factors make it impossible to forecast the outcome of tax control activities and reduce the efficiency of further remedies available to taxpayers. Furthermore, when defending its tax interests in court, the Company cannot be guaranteed that its tax case will be considered impartially for various reasons, including the political ones. The Company closely follows up on changes to the tax legislation and law enforcement practices related to tax cases in order to timely incorporate these changes into its tax obligations. |

|

|

Operational risks |

Asset-related operational risks Business interruption risks This risk is caused by any factors that can lead to business interruption. Meanwhile, this risk includes both a direct stoppage in production resulting from physical damage of the equipment, and a consequential business interruption resulting from material loss at an outside facility that does not belong to the Company, and is not maintained or managed thereby. The main factors when assessing the possible losses include turbine oil catching fire, damage of the turbine wheel space, explosion of the boiler at ignition, explosion at the chemical water treatment ammonia storage, washout of the water gathering pond dam, etc. In order to reduce probability of negative events, the Company takes the following measures: |

|

|

Asset-related project risks Risks associated with Berezovskaya GRES Power Unit No. 3 recovery A fire outbreak in the boiler house of Power Unit No. 3 of Berezovskaya GRES, that caused damage to the boiler, occurred on 1 February 2016. The fire was extinguished. Power Unit No. 3 of Berezovskaya GRES is currently under repair. There is a risk that the actual date of putting Power Unit No. 3 of Berezovskaya GRES into operation may differ from the scheduled one. The factors of this risk include unscheduled works (design and planning flaws, remedial works, accidents, etc.) and delays by contractors. The Company pays maximum attention to managing this risk through careful monitoring of the repair process. Moreover, the Company partially insured risks related to the project “Recovery of Power Unit No.3 at Berezovskaya GRES |

|

|

|

Legal Risks The Company continuously monitors changes in the requirements of the applicable law and manages legal risks associated with its operations. The Russian law is unstable and subject to frequent adjustments, additions and amendments, which in itself creates significant risks to doing business. Additional difficulties are related to the fact that there is frequently ambiguous interpretation of some particular legal provisions by judicial and other law enforcement bodies, which decreases legal certainty in regulation of specific legal relationships. Legal risks associated with significant and frequent changes in the law that governs the Company’s core business are of special significance to the Company. The Russian energy law is new, abundant, of complex hierarchy, structure and content of the provisions. Active state regulation of the power industry leads to frequent revisions in the most critical legal acts in this field, which creates the risk for stable and predictable business. The increasing legal risks are associated with more stringent requirements of anti-trust law, persistent volatility of regulation of tax relations, and cases of misapplication of laws on the part of regulatory and controlling state authorities. The Company exerts all efforts to properly identify and mitigate the above legal risks, ensuring strict compliance with the applicable law in doing business. Moreover, the independence of the Russian judicial system and the reliability of mechanisms protecting it against any economic, political and social impact have not been tested enough in practice yet. The judicial system suffers the shortage of competent staff and lack of funding, as well as an overload due to a great number of court cases pending. The enforcement of judgment may prove to be difficult. Frequent reforms to the organisation of courts and amendments to the procedural legislation, including the matters of competence of the court and its jurisdiction over a case, together with changes in approaches applied by courts to any particular category of cases, bring even more incertitude to the judicial system operations. The said factors make it impossible to predict the outcome of court proceedings in Russia and guarantee the efficiency of remedies. Moreover, sometimes claims may be brought to courts or administrative authorities, or a prosecution may be initiated for some political, competitive, administrative or other reasons rather than on legal grounds. Such actions can also be initiated against Unipro PJSC with no guarantee of impartial trial. The Company carefully and regularly studies changes in judicial practice related to its activities so as to ensure their timely consideration and take them into account in any then-current proceedings held with participation thereof. The judicial practice is analysed at the level of both the Supreme Court of the Russian Federation and commercial courts; the Issuer also examines the legal position of the Constitutional Court of the Russian Federation on certain law enforcement matters. In addition to changes in the existing judicial practice related to the Company’s activities, which may affect its performance, Unipro PJSC may also be involved in proceedings within which a new judicial practice unfavourable for the Company can be produced (e.g. the fact that equipment has been under emergency repairs for a long time may be used to terminate a capacity supply agreement by a court order). |

|

|

|

Political and regulatory risks The Russian wholesale electricity market regularly undergoes changes, which affects both the structure of the electricity market and relations between its participants. According to the Company’s estimates, the important industry-specific risk that may significantly affect Unipro PJSC is the risk of change in functioning rules for the electricity and capacity market. Increase in the share of the regulated component in the wholesale market negatively affects the Company’s yield because it reduces the share of more efficient sales at non-regulated (free) prices. |

|

Risks insurance management

In Russia, Unipro PJSC has the reputation of a leading insurer, whose experience is exemplary for the market.

The Company forms its insurance coverage according to the corporate Insurance Policy of Uniper SE under the supervision of corporate insurance broker Uniper Risk Consulting GmbH (URC).

Risk insurance function in Uniper SE is responsible for the implementation of measures related to the solution of insurance tasks within the perimeter of the entire Uniper group.

Together with the risk owners (legal entities, including Unipro PJSC) and the responsible functions of the group, the insurance function determines whether it is necessary to use insurance contracts concluded by Uniper, coordinated programmes, regional or individual insurance contracts to cover the risks considered. Insurance tasks are solved taking into account commercial, legal, and regional aspects.

The insurance function is performed by achieving the following goals: